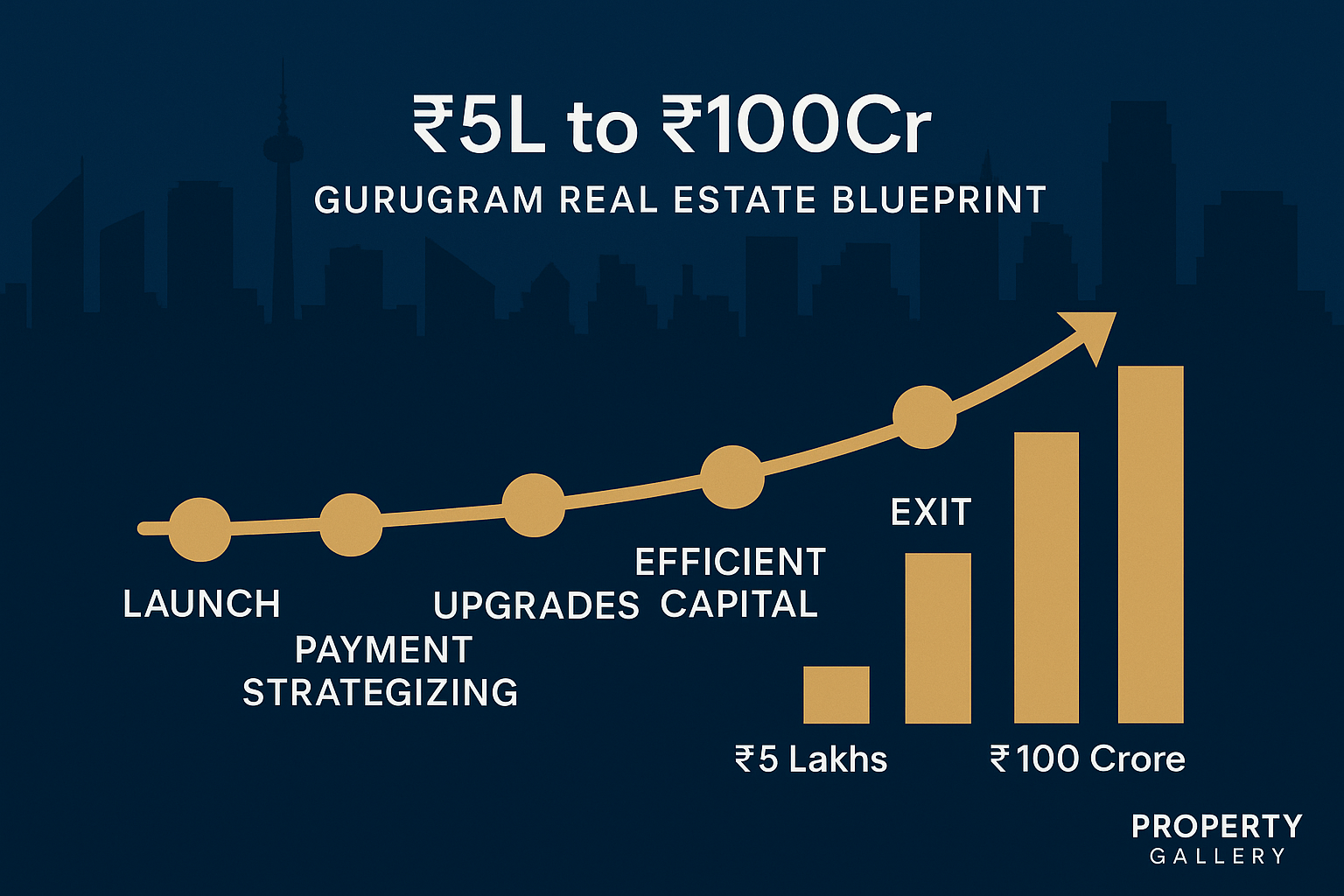

Building a ₹100 crore property portfolio from just a few lakhs sounds mythical but according to Gurugram advisor Aishwarya Shri Kapoor, it’s achievable with a disciplined, repeatable 5‑step strategy. Unlike relying on luck or rising prices alone, this approach focuses on precision timing, smart upgrades, and capital efficiency.

Here’s how savvy investors are turning modest capital into serious wealth in Gurugram one strategic move at a time.

Buy at Launch Seizing the Best Entry

The first principle is simple: enter early. At launch, developers offer lower entry prices. For example, purchasing a 2,000 sq ft unit at ₹12,000 per sq ft and reselling at ₹14,000 locks in a ₹40 lakh gain before delivery.

Why this works:

-

Launch prices are often 10–15% below peak

-

Inventory is plentiful and discount structures are attractive

-

Early buyers set the tone for resale benchmarks in that micro-market

If you wait, you lose – it's not just about market growth, it’s about activeness.

Negotiate Smart Payment Plans

Developers value liquidity, and payment structure matters. Moving from a 40:60 down payment plan to a 50:50 or flexible plan can unlock instant 3–5% price reduction.

What this means for you:

-

Reduces upfront capital blocked

-

Yields immediate ROI without waiting for price appreciation

-

Improves overall return on investment

Use their need for quick cash as your negotiation edge.

Reposition & Upgrade Strategically

Buying at launch is step one improving the asset is step two. Whether it’s high-end tiles, better fixtures, or premium placements, spending ~₹300/sq ft can add ₹500–600/sq ft in resale value.

Why this works:

-

Buyers skew toward move-in ready homes

-

Small upgrades appeal to premium buyer segments

-

ROI calculated: (Resale premium – cost) / cost often yielding 50–100%

It’s value creation that delivers returns without speculation.

Optimize Capital Efficiency

Never block all your capital at once. Tie payments to construction milestones so your money can earn interest or be vested elsewhere.

Capital efficiency helps in two ways:

-

You maintain liquidity and flexibility

-

Interest or rent savings boost total returns

Think of your capital working 365 days don’t let it sit idle.

Time Your Exit It Matters More Than You Think

A crucial insight: exit timing defines returns. Selling within 6–12 months post-possession can offer 12–15% IRR over 3–4 years. Push that exit 18 months later, and IRR drops to 7–9%.

Fast exits help because:

-

Demand peaks post-possession, not later

-

Holding longer increases risk and cuts compounded gains

-

Time is leverage use it, don’t lose it

Timing - not just asset - is your biggest wealth lever.

Understand Micro-Markets One Gurugram, Many

Gurugram isn’t a single market. micro-markets (Cyberhub, Golf Course Road, UER‑2 etc.) each have unique drivers.

What this means:

-

Don’t generalize price trends

-

Assess metro/office zone connectivity, zoning, and upcoming infrastructure

-

Shortlist micro-markets with best entry and exit points

Depth beats breadth position precisely.

Due Diligence Because Hype Doesn’t Pay Rent

Skip this at your peril. Check:

-

Rental viability (Cash‑on‑Cash return vs. FD)

-

Clean legal title and RERA registration

-

Developer delivery record and quality standards

-

Comparable sales in a 1 km radius

-

Project financing structure 7 See if break-even occupancy is realistic.

If rental yield is below a fixed deposit’s interest rate, rethink.

The Compounding Power of Repetition

Repeat these steps launch entry, smart payment negotiation, upgrades, efficient capital, timed exit across multiple deals and corridors. Over 5–10 years, the multiplicative effect can turn modest investments into multi-crore portfolios.

The method:

-

Build capital through small, consistent wins

-

Deploy proceeds into higher-value projects

-

Stay agile, data-led, and unemotional

-

Gradually shift from residential flips to commercial land/SCOs, earning stable 6–9% yields

Conclusion: Strategy Over Speculation

The message? Wealth isn’t built by chance it’s engineered. Aishwarya Kapoor’s 5‑step formula proves that even starting from lakhs, anyone can achieve crores by mastering timing, negotiation, value-add, and liquidity.

At Property Gallery, we specialize in micro-market analysis, developer vetting, and corridor forecasts, so you can execute this plan with clarity and confidence.

Ready to start? Connect with us for curated Gurugram deals, capital efficiency checklists, and early access to launches aligned with this strategy.